- April 24, 2024

-

-

Loading

Loading

Unless extended for a second time, the governor’s executive order regarding mortgage foreclosure and eviction relief will expire on Oct. 1.

The order allowed property owners to initiate eviction processes in any situation, but halted the final action for evictions of people affected by the COVID-19 crisis.

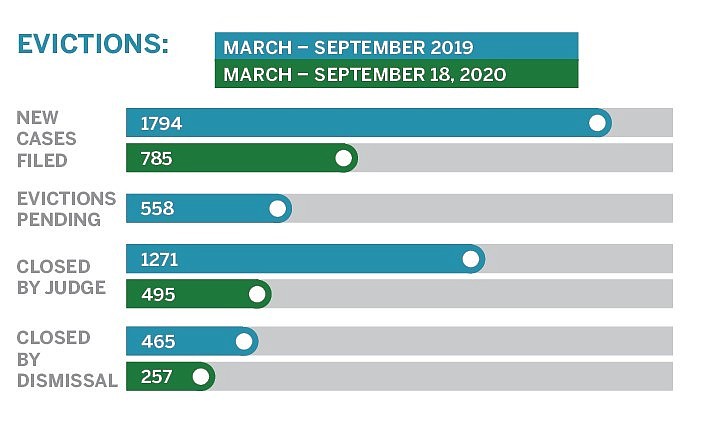

If the order expires, what could that look like in Volusia County? According to data from the Office of the Clerk of the Circuit Court, a total of 785 new eviction cases were filed from March until Sept. 18, 2020. It’s a sharp decline from 2019 data from the same six-month time period, which saw 1,794 new cases filed, indicating a potential backlog of cases that would normally qualify for evictions. That has left property managers in a difficult situation.

As of Sept. 17, 2020, the clerk had 330 open eviction cases. Around the same time in 2019, there were 558 evictions pendim, according to clerk’s data.

Additionally, on Sept. 4, the Centers for Disease Control and Prevention issued an order to temporarily halt residential evictions due to failure to pay rent. Under that order, if affected residents sign a declaration of intent stating they have tried to obtain government assistance for rent, they are unable to make payments and they meet certain financial parameters, landlords cannot evict them until after the order expires on Dec. 31.

At least one local property manager hopes the governor allows his executive order to expire. Continental Property Services Inc. manages seven properties in the Ormond Beach and Daytona Beach area, including Oaks of Lakebridge and the Coral Sands Resort in Ormond Beach. President Russell Bryant said that out of their 1,371 apartment units, they have fewer than 20 from which they want to evict tenants. There are more tenants that have struggled financially due to the pandemic, but Bryant said they’ve been in contact with them to help modify the terms on their lease. The tenants they wish to evict are those that have cut out all communication and have not signed the declaration, he said.

“We’ve got some people that haven’t paid us since March,” Bryant said. “At the same token, we don’t want to put people out on the street that are deserving.”

He said the eviction of residents is a property manager’s “last resort” as well, but that there are some that are taking advantage of the situation.

In 2019, Bryant estimated his company had to evict about six tenants. This year, that figure is likely to double.

There are local resources to help tenants struggling with making rent. The Volusia County Council voted to boost the county rent and mortgage grant program by an additional $5 million, to total $22.5 million in program funding, at its meeting on Tuesday, Sept. 29. A total of 6,377 applications had been received at the county as of that meeting, and 4,113 have been approved so far. The county has expended over $11.1 million of its program funding, and $1.2 million are pending.

Communication is key when trying to help tenants, said Becky Guthrie, of Rent Me Homes, in an email. They manage about 200 properties, 90 of which are in Ormond Beach where only three tenants have requested aid from the county.

“We like to believe our tenants will come to us with their challenges,” she said. “That’s the only way we can help them. I think they do come to us.”

Rent Me Homes has not had any evictions to process during the pandemic, but Guthrie said filtering through the legal policies in place has been a challenge. She explained that they have been able to modify tenants’ deposits to help them stay current and pay their landlord.

The loss of revenue from tenants not paying rent on any given month isn’t cause for alarm on its own, Bryant said, but when added up for the past six months, that figure starts to become significant, even with their high number of units. Smaller property management companies or individual landlords are likely the ones that have been impacted, he said.

In the end, he believes it’s six months’ worth of money they’re not likely to get back, despite the governor’s order and the CDC stating tenants will still owe landlords for the missed rent. Unlike mortgages, Bryant said, apartments lease time.

“So once the time has passed, we can’t go back and get it,” Bryant said.

His rental units are pushing a high occupancy as well, and with nonpaying tenants occupying certain units, Bryant said they are beginning to see availability issues now.

Conversely, Guthrie said that Rent Me Homes’ property manager hasn’t seen a lack of invetory, as investors are still buying and tenants continue to rent. But, they are also experiencing higher occupancies with more people staying put and renewing their leases due to the pandemic.

“Everyone wants stability,” Guthrie said. “When we lose a tenant, it is more than likely due to a home purchase because of the low interest rates or the landlord wanting to sell due to high sales values. We are not seeing, as of yet, fluctuations in inventory, due to evictions.”

What could be a longterm effect of the evictions moratorium? Bryant said application processes may get harder for renters in the future, as landlords vet them for reasons they didn’t pay any rent in 2020. On the other side of the coin, some landlords’ losses could cause them to put their investment properties on the market.

“I look at it as a snowball that’s speeding up going downhill,” he said.

Guthrie said she doesn’t foresee a lasting impact to the renter market, but that it may be too early to tell. What they are seeing is more tenants relocating from out of state.

“Our rental market is usually pretty steady,” she said. “Over the years, we have not seen nearly the fluctuations as the sales market.”

This story was updated at 9:57 a.m. on Thursday, Oct. 1, to correct the graphic featured in this article. A previous version reversed the 2020 data with the 2019 data.