- April 26, 2024

-

-

Loading

Loading

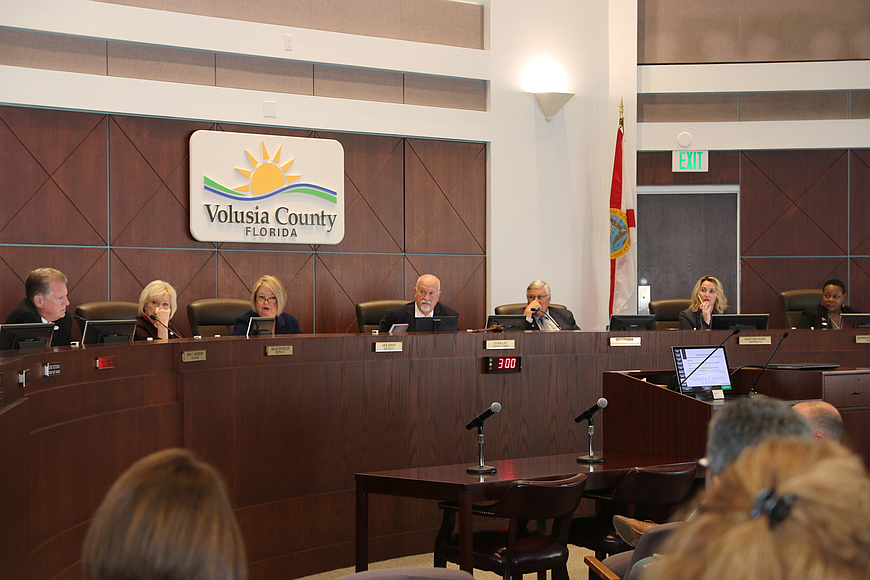

The issue of rebuilding public trust continues to be at the forefront of various Volusia County Council members' minds as the May special election for the half-cent sales tax approaches.

Volusia County is currently holding public sales tax project meetings around the county to gather public input on the county's proposed list of projects to be funded by the sales tax, should it pass. At the County Council meeting on Tuesday, March 5, Councilwoman Barbara Girtman brought up the topic of trust during her final comments. She said she had met with five citizens after the sales tax project meeting in DeLand the night before, and that several of them — which were young people — voiced concerns about the citizens advisory review committee that will be enacted to review the sales tax project funding and its proposed usage.

Girtman said they wanted to know what "teeth" the committee will have.

“To have people that young not trusting local government, I think we have a little work to do," Girtman said.

County Council Chair Ed Kelley said the committee will be made up of one person appointed by each city, and wanted to point out that the council is putting the half-cent sales tax on the ballot at the request of all 16 municipalities. The council is the only government entity that could put it on the ballot, he said.

“It’s not a County Council-driven initiative," Kelley said.

County Councilman Ben Johnson said impact fees continue to be discussed, despite the fact fees have already been raised.

“We booted it," Johnson said. "We’ve admitted we booted it. But we went back on that and tried to correct it as best we could and it’s going to be corrected in years to come, and somewhere along the line, we have to bury this history and say, ‘let’s go ahead. What’s best for the county?’”

Going with a half-cent sales tax is the best option Volusia has to address its infrastructure and water quality needs, Johnson said. The other option would be raising the ad valorem taxes, which are paid by less people in the county. He said there is a lack of trust, and that the council is working to fix that. That's why he said there needs to be people on the committee who will have voted against the sales tax.

Trust is a two-way street, said County Councilman Fred Lowry. He explained residents can't get their information from social media and understand what is going on in government. If the county had raised impact fees every since 2003, Lowry said Volusia would be in the same position it is today. Impact fees can only be used in areas by new development, he said.

Kelley said there is no other way to create funds that are able to be bonded and are partially generated (between 35-40%, according to Kelley) by visitors. Impact fees couldn't fix 90% of the infrastructure projects he's seen have been proposed to be funded by the sales tax.

“There’s nothing else," Kelley said. "This is it.”