- April 19, 2024

-

-

Loading

Loading

The sooner public health safety measures can be eased, the quicker the U.S. economy will recover, said a University of Central Florida economist during a virtual Eggs and Issues meeting hosted by the Daytona Regional Chamber of Commerce on Thursday, June 11.

Economist Sean Snaith gave an overview of what economic recovery will look like going forward, and what issues have a potential to affect how long the recovery will take, both at a local and state level. Citing the National Bureau of Economic Research findings that February marked a peak of economic activity, Snaith not only said that March marked a recession due to COVID-19, but that it was the deepest recession since the Great Depression.

A recession that we have quickly exited, he added.

“This was no ordinary recession," Snaith said. This was not a recession that came out of the natural mechanisms of the economy that are part and parcel of the business cycle and always will be.”

While the NBER stated a recession is typically defined by economic downtown that lasts more than a few months, it still considers this recent decline as a recession, according to the report.

"The committee recognizes that the pandemic and the public health response have resulted in a downturn with different characteristics and dynamics than prior recessions," the report states. "Nonetheless, it concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions."

Snaith said that the Department of Labor's job report for the month of May, showing that 2.5 million jobs were added to business payrolls and that unemployment rate declined to 13.3% from April's 14.7%, is an indication of an economic upswing. He predicted that the future state of the economy will rely on the public health safety measures in place, and that he believes there won't be a second round of stay-at-home orders.

“It’s my opinion that we can’t endure another round of shutdowns, nor should we, regardless of what happens going forward as we open up," Snaith said. "While we were all hiding under the covers, COVID-19 didn’t go away. The boogeyman is still out there and ultimately, data and science will help us in this regard.”

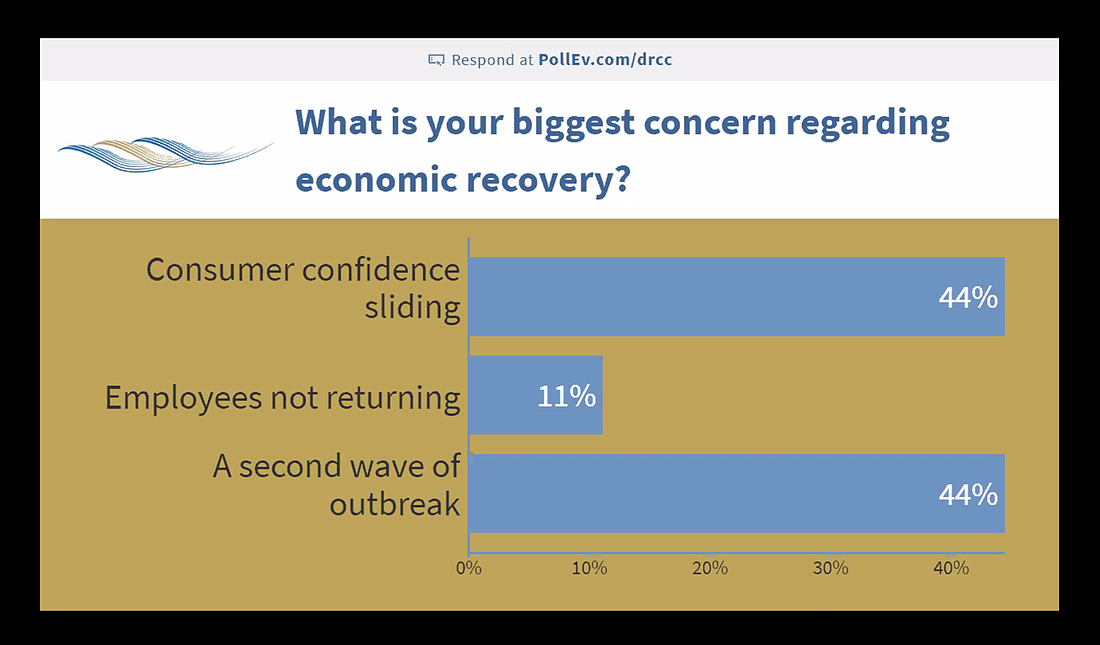

In a poll conducted at the beginning of the Zoom meeting, 44% of the participants said they were concerned over a second wave of a COVID-19 outbreak.

He cautioned listeners to be wary of experts and models making predictions on the future impacts of COVID-19. To fully understand the fatality of the virus, more data is needed, Snaith said.

One of the issues that could prolong the economic recovery process is what Snaith called the "fear factor," with people remaining afraid to frequent businesses and travel, as Volusia County, and the state of Florida as a whole, rely heavily on tourism. Another factor that could impact the recovery is the outcome of the presidential election in November. However, Snaith said that is to be expected, since the economy is impacted with every presidential election.

All in all, he said he expects the economy to get back on track to its pre-COVID-19 status in a year or so.

In regards to the housing market, Snaith said that, unlike the 2008 recession, Florida's market has remained steady. He said this is likely because the people most financially affected by the coronavirus are also the same group of working class individuals not likely to have been buyers prior to the recession.

“I think the demand is out there still," he said. "I think the fundamental problem in the housing market in Florida remains a lack of inventory. There is a shortage of single-family housing.”

His concern for economic recovery remain focused on the public health safety measures. In the beginning, the aim of the measures was to flatten the curve to allow hospitals the capability to handle a surge in patients. Snaith said there appears to be a shift in focus.

“Now, it’s not clear in my mind what the objective might be," Snaith said.